7 Ways Financial Independence Retire Early Preys on Naive 20-Somethings

I graduated college then started working as a software engineer in 2006 (and found I hated office jobs with a fiery passion).

So I totally understand why the FIRE movement appeals to young 20-somethings. And I’m not hating on the movement; I think if you hate your job that much, then working to change your circumstances is a great goal.

That said, there are some pitfalls with the movements methodology that only naive 20-somethings could fall for. As a 37-year-old who has lived it, make sure you prepare yourself for the following 7 realities.

1) Compound Interest Has An Achilles Heel

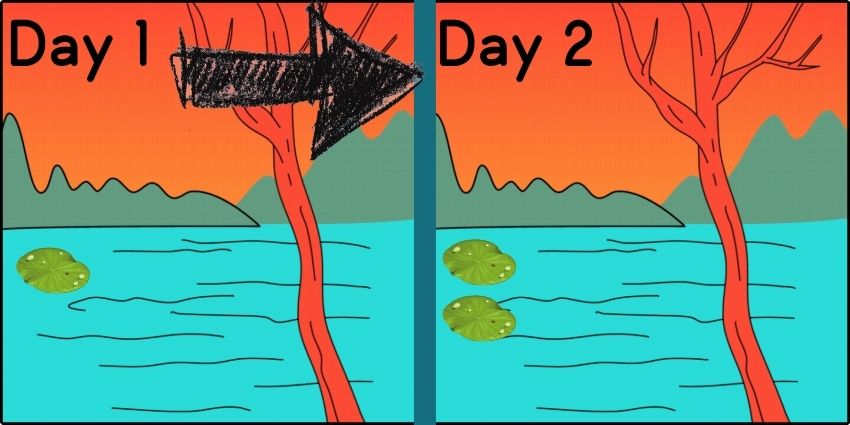

Imagine a lake with 1 lily pad. Every day the number of lily pads doubles.

If it takes 100 days to fill the entire lake with lily pads, on what day would the lake be half full?

The answer is Day 99!

The answer becomes obvious when you run the thought experiment in reverse. Start on day 100 with a full lake and cut your lily pads in half every day.

- Day 100: 100 Lily pads

- Day 99: 50 Lily pads

- Day 98: 25

- Day 97: 12.5

- Day 96: 6.25

- Day 95: 3.125

- Day 94: 1.56

- Day 93: 0.78

- Day 92: 0.39

- Day 91: 0.195

- etc…

This thought experiment reveals the problem with relying on compound interest to solve your financial woes.

On day 90, you’re only 0.1% of the way to your goal. A short-term setback can easily send you back to day 0 (or worse). But a financial disaster would never happen to you, right?

2) An Epic Financial Disaster Will Definitely Happen To You

When I was 29 years old, I was doing great financially, so I decided to buy a house.

After closing on a lovely house, my company lost a big contract and laid off half its workforce (myself included). I then had to take a pay cut to get re-employed as fast as possible because I wiped out my savings to buy the house and had dipped into credit card debt to survive.

I tell that story to point out that something bad financially will happen to all of us one day. As much as we all love the idea of personal responsibility, you’re a fool if you think you’re going to avoid all the potential pitfalls coming your way.

- Medical problems / medical debt.

- Surprise Layoff

- A significant asset (like a house or car) being destroyed and insurance not fully covering it.

- An expensive wedding or expensive spouse

- An expensive divorce/alimony

- Kids (hopefully not with expensive special needs)

- A lawsuit

- A failed business

- extreme burnout / mental fatigue causing you to need a long sabbatical.

The FIRE movement tends to just ignore all these impending financial disasters. This is a huge mistake because as a 37-year-old man, I don’t think I know a single human being my age that hasn’t experienced at least one of these things.

Combine these short-term disasters with your reliance on compound interest, and you should see the obvious problem with relying on compound interest to save you.

3) You Might Actually Enjoy Working Someday

Over the past 15 years, I’ve grown to hate my job less and less for several reasons.

- Remote work has become normalized, thanks to the pandemic.

- I get paid 3x what I was making initially.

- I have twice as many vacation days as when I started.

- I have a lot more power at work than I used to.

Better than that, I run a business! I blog, YouTube, and write apps. I haven’t quit my job for it yet, but when I do, I don’t ever really intend to retire from the business (because I love it).

Are you definitely going to find a job or business you love in the next 20 years making the whole FIRE attempt feel extremely stupid?

I can’t say that you definitely will. But you can’t know that you definitely won’t. And that should be enough to give you pause. Are extreme financial sacrifices now warranted if you end up in an enjoyable job 10+ years from now?

4) The Reliance on Austerity is Shortsighted

I made a lot of cuts to expenses in my 20’s I was actually quite happy with.

- Living with Roommates (at least in my early-mid 20’s)

- Cutting cable.

- Buying food from the grocery store rather than eating out.

- Avoiding expensive clothing.

- Swapping out my incandescent light bulbs with LEDs that used 10x less power/heat.

These are examples of good cuts in that most of them actually improved my quality of life at the time. And it saved me money. I’m not arguing against this type of austerity.

What I’m arguing against is the type of extreme austerity I sometimes see coming from the FIRE movement. I read about one guy who shut off heat in the Winter while living in Pittsburgh. Or people living in vans, etc. That’s insane!

Please don’t make these types of extreme cuts to reach financial independence in your 20’s. Particularly when you might be making 2x-10x as much money in your 30’s.

5) The Reliance on Austerity Stifles Growth

If you were really into austerity (and my age), you might have done any or all of the following.

- Bought a smaller house than you could afford (or rented).

- Not starting a business because there’s too much startup capital involved.

- Avoided any speculative investments like Bitcoin for fear of losing any money.

- Not going back to school because it will set you back financially.

- Not buying the best camera, computer, or software you could have because it was too expensive.

Sometimes things that seem like expenses in the moment are actually incredible investment opportunities.

For instance, I bought Bitcoins in 2014, when they were maybe $200 a coin. Then I sold them a year later because I felt like I was broke (due to the layoff I had at my job). Those Bitcoins would be worth hundreds of thousands of dollars today, and any credit card debt I might have accumulated seems very small in comparison.

6) Investments Can Look Very Bad With Short Time Horizons

If you need to be retired by 35, it really caps how long you can wait for an investment to pay off.

For instance, my house. I overextended buying it, and it was a major financial burden my first few years of ownership. That said, in 2020 there was a housing boom where that same house increased in equity by $100,000 (seemingly overnight).

If I needed that investment to have paid off by the time I was 35 (5 years after I bought it)… I would have missed the housing boom.

And that’s how most investments go. Even if you know a boom is coming, it’s impossible to predict the exact date the boom is going to happen. And if you time limit is your 35th birthday, you’re left with an extremely short investment horizon.

7) Retirement’s Not THAT Great

Don’t get me wrong, not going to a job every day is incredible.

I know because I’ve done it! I left my job for a business in 2016 (before the business failed over a year later and I had to beg for my job back). And it was an amazing year, I won’t lie.

That said, it wasn’t THAT amazing.

I blamed my job for 100% of my problems prior to quitting. But, in reality, my job was only responsible for like 45% of my problems tops. And as awesome as it was to watch 45% of my problems disappear for an entire year, it still left me with most of the same problems.

What I’m saying is don’t put retirement up on a pedestal. It’s great, but it’s not so great that it’s worth living in austerity for a decade.